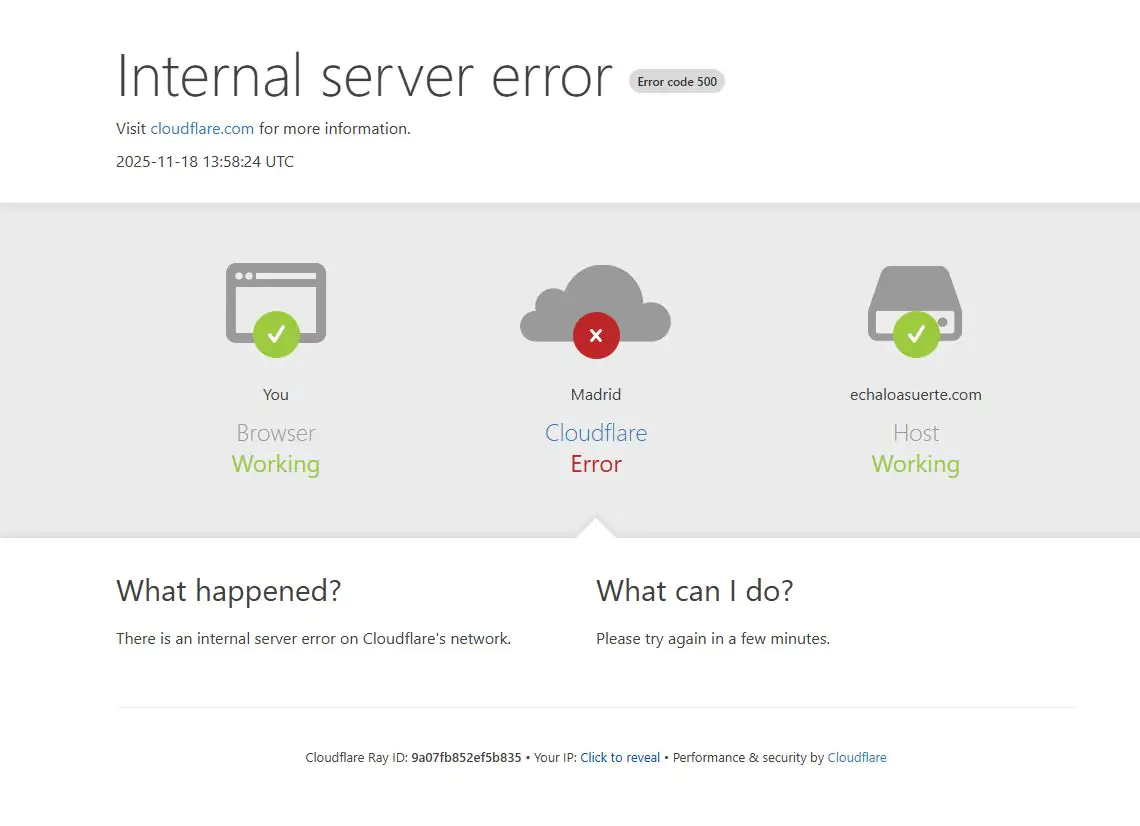

When websites began timing out on the morning of November 18, 2025, my first instinct was to assume local connectivity issues. But as pages failed to load across multiple devices and colleagues reported the same symptoms, a clearer pattern emerged: a major segment of the global internet was malfunctioning at once. Within minutes, engineers and traders worldwide identified the common denominator — Cloudflare.

By midday UTC, it became evident that this was not a routine hiccup. According to Cloudflare’s own published incident analysis, a configuration change triggered a “latent bug” in its bot-management feature. A background process generated a corrupted feature file that exceeded the proxy software’s size limit, causing Cloudflare’s globally distributed edge servers to crash. Because the faulty file re-propagated every five minutes, the system effectively cycled between partial recovery and fresh failure until engineers halted the process, replaced the file, and issued restarts. Cloudflare restored core functionality by around 14:30 UTC, with full resolution confirmed shortly after 17:00 UTC.

The impact was immediate and wide-ranging. Cloudflare supports traffic for roughly 20% of all websites, including major platforms such as ChatGPT, X, Shopify, Canva, Spotify, and numerous government and transportation portals. During the outage, users witnessed cascading failures: login systems stalled, API calls timed out, dashboards froze mid-refresh. Crypto traders found that several centralized exchanges and DeFi interfaces — many of which depend on Cloudflare for DNS and DDoS protection — became temporarily inaccessible, even though underlying blockchains continued operating normally.

Tech Stocks Reacted First

Financial markets typically respond mildly to transient infrastructure outages, but Cloudflare’s position as a critical internet intermediary made this incident different.

Multiple verified financial sources reported quantifiable share-price movements:

2%–3% immediate decline during early US trading hours (CNBC and TipRanks reporting).

A sharper intraday drop of around 7%, captured in INDmoney’s live market timeline.

An end-of-day decline of roughly 2.8%–3%, noted by Munsif Daily.

Analyst summaries suggested that investors were pricing in both the direct reputational impact and the broader realization that Cloudflare remains a single point of failure for a substantial portion of global internet traffic.

Finimize’s market briefing contextualized the event within a broader tech pullback. Amazon and Microsoft were already under pressure due to ongoing European regulatory scrutiny, and the Cloudflare outage “added weight to an already negative session.” Their reporting recorded declines in several tech-related instruments, including:

Technology Select Sector SPDR Fund (XLK): approximately −0.9%.

SPDR S&P Semiconductor ETF (XSD): around −0.6%.

Philadelphia Semiconductor Index (SOX): roughly −1.4%.

While the broader S&P 500 remained stable, the tech sector showed clear sensitivity to the interruption.

Crypto Traders Faced Interface Outages, Not Price Crashes

Blockchain-native media, including BeInCrypto, documented multiple well-known exchanges and web-based crypto dashboards going offline during the event. These platforms rely heavily on Cloudflare’s DNS, caching, and security services. When Cloudflare’s infrastructure failed, the front-end layers of these exchanges simply did not load.

Despite the sudden user-side disruption, major cryptocurrencies did not experience correlated price swings, confirming that execution engines and blockchain networks remained functional. The episode instead highlighted an often-ignored reality: even decentralised ecosystems rely on centralised web providers for user access.

During that period, I watched several traders in internal chats and newsroom channels attempting to reload interfaces, switch browsers, or run their own API calls. It was a rare moment in which the modern digital trading environment felt abruptly fragile — not because markets moved violently, but because the tools required to observe them briefly disappeared.

A Structural Vulnerability Laid Bare

Cloudflare’s post-incident timeline demonstrates how narrow the margin is between normal global internet operations and unexpected global disruptions. A single configuration error — not a cyberattack, not a power failure — cascaded into a multi-hour worldwide outage affecting millions.

This event exposed several important structural realities:

Centralization risk: A single infrastructure provider can accidentally disrupt substantial portions of the public internet.

Market dependence on uptime: Trading, payments, authentication, and content delivery systems rely on uninterrupted connectivity.

Crypto’s paradox: Even ecosystems built on decentralization may depend on centralized web gateways.

Tech-sector sensitivity: Share prices of mid-cap infrastructure firms respond sharply to operational failures.

While global markets did not enter a volatility spiral, the outage served as a reminder that technological infrastructure has become as essential — and as vulnerable — as any traditional utility.

A Reporter’s Perspective From Inside the Disruption

Throughout the outage, the most striking observation was how quietly the disruption unfolded. Newsrooms, trading desks, and developer channels all experienced the same freeze: web tools locked mid-request, dashboards spun indefinitely, and AI assistants returned Cloudflare-specific error codes. The disruption did not feel dramatic; it felt eerily silent. Analysts and reporters, myself included, shifted briefly to offline notes, cached data, and manual cross-checks — echoes of a pre-cloud era.

It was a rare reminder that even in 2025, the digital systems we treat as omnipresent are still built on human-maintained layers of code, configuration, and infrastructure.